Building Your Credit Score

In the US, protecting your credit score is just as important as protecting your passport.

Golden Rule: Never get yourself into unmanageable debt.

Your financial integrity is your passport to opportunity, so treat it with care.

A good starting point:

- Use no more than 30% of your available credit.

- It’s not just about how much you use – it’s about showing steady, responsible trends over time.

The Big Three Credit Bureaus

Your credit information is tracked by three main agencies: Equifax, Experian, and TransUnion.

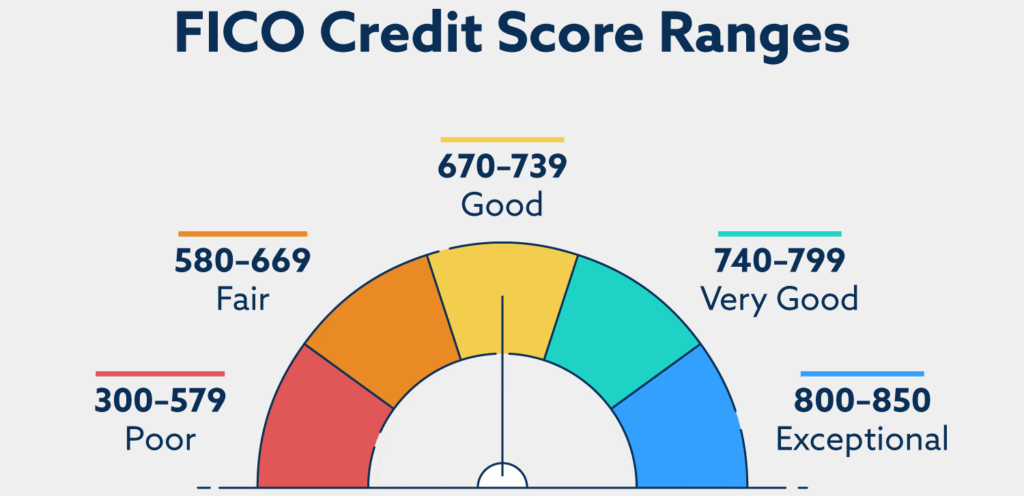

The 5 Keys to Your FICO® Score

- Payment History – 35% of score

Your track record of paying bills matters most. Late or missed payments – especially if recent or frequent — will hit your score hard. - Amount of Debt – 30% of score

How much credit you’re using compared to what’s available (credit utilization) is critical. Keep balances low and spread across fewer accounts. - Length of Credit History – 15% of score

The longer your accounts have been open, the better. Both your oldest and average account age are considered. - New Credit – 10% of score

Opening many new accounts in a short period is risky in the eyes of lenders. Only apply when you really need it. - Credit Mix – 10% of score

A healthy variety of credit types (credit cards, loans, mortgage) shows you can manage different financial responsibilities.

Other Important Factors

- Credit Inquiries – Every time a lender checks your credit for a new application, it can lower your score. Avoid multiple applications close together.

- Public Records – Court records, rental agreements, car leases, and utility accounts are often reported. Pay on time, avoid partial payments, and stay in good standing.

How to Raise Your FICO® Score

Improvement takes consistency, but small steps add up.

1. Payment History

- Pay all bills on time – set up autopay if possible.

- If you’ve missed payments, catch up and stay current.

2. Credit Utilization

- Keep balances below 30% of your available limit.

- Pay down high-interest balances first.

- Make small payments throughout the month to keep utilization low.

3. Credit Mix

- A variety of account types is good, but don’t open too many new ones at once.

4. Other Tips

- Check for errors: Review your credit report regularly and dispute inaccuracies.

- Authorized user: If possible, become an authorized user on someone’s well-managed credit card.

- Experian Boost: Add on-time utility and phone payments to your credit profile.

- Be patient: Building (or rebuilding) credit takes time – steady habits win.